Books Authored

Author: Varun Chandna

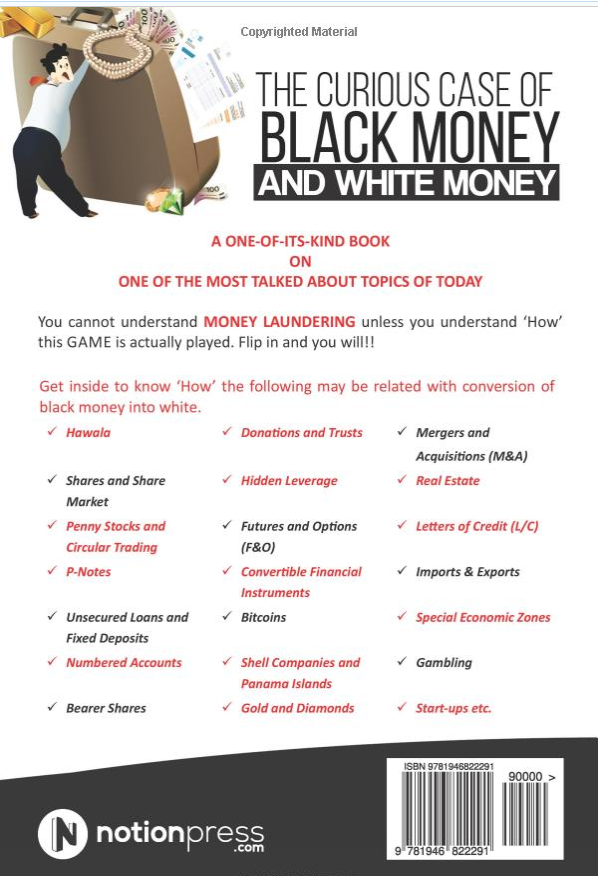

The Curious Case of Black Money and White Money

As a student of commerce, I was always fascinated as to how people convert their black money (Dirty Money or No. 2 money) into white (Clean Money or No. 1 Money). I had no real idea of this business and in the entire CA curriculum, there was no subject that would teach how to do this intricate job. After completing my CA, I went into the financial and banking sector jobs where trainings on compliances and Anti-Money Laundering were a regular affair but still they never focussed on how the launderers actually worked.

While working with MUFG Bank, I used to think about generation and laundering of black money being a big menace and a lot of statistics also suggested the size of this shadow economy to be no lesser than the real economy. Different statistics, but the ways of laundering are almost the same. Read More

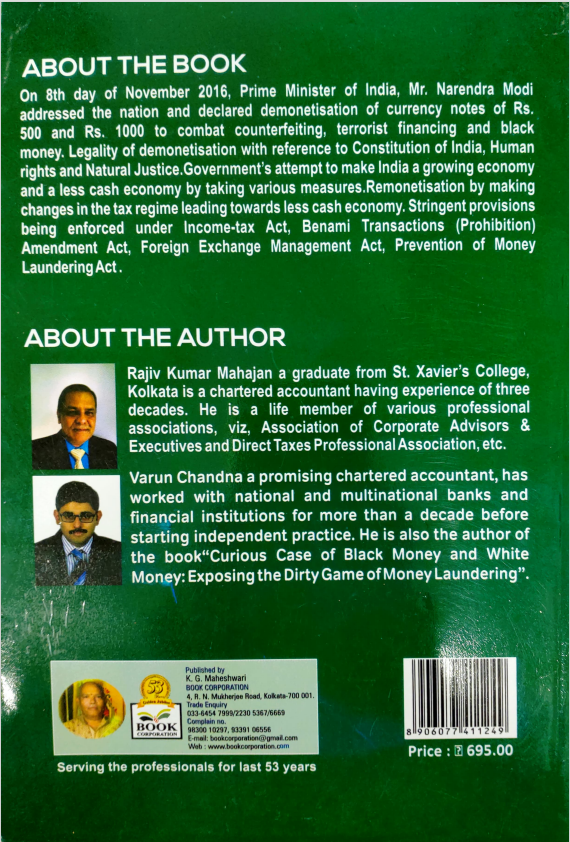

Author: Rajiv Mahajan & Varun Chandna

Tax Regime Compliance and Digitalisation

This book was written during the time of November’ 2016 till December’ 2016 when India was witnessing the unprecedented currency crisis due to demonetisation of Specified Bank Notes of denomination INR 500 and INR 1000.

The authors have tried to cover the regulations issued by Government of India and Reserve Bank of India during the said period to deal with the economic, political and social scenario formed during the said time and compliance of the same.

It also covers how demonetisation changed the taxation landscape of the country forever.